6 Issues Democrat And Republican Economists Agree On

Did you know only 22 of 50 states require high school students to take an economics class to graduate? And only 3% of colleges in the United States require an economics course to graduate?

This means most people are only exposed to economic principles through campaign promises and Facebook memes instead of the classroom. And we wonder why economic issues are such hot-button topics. Most people — usually those most vocal — have strongly held beliefs on a topic they don’t fully comprehend the complexities of.

While it would be great to have citizens fluent in economic principles, luckily we all don’t need to run out and get a PhD in Economics– there’s plenty of PhD Economists out there to do the research and debating for us.

We just have to listen to what they’re telling us.

To make it easier for the public to keep up with the latest economic research, the University of Chicago Booth School of Business put together the IGM Economic Experts Panel, where they hand-pick economists across focuses and political leanings and poll them on specific economic policies.

Surprisingly, there are a number of topics economists from across the political spectrum overwhelmingly agree on. Here are some of the more notable topics–

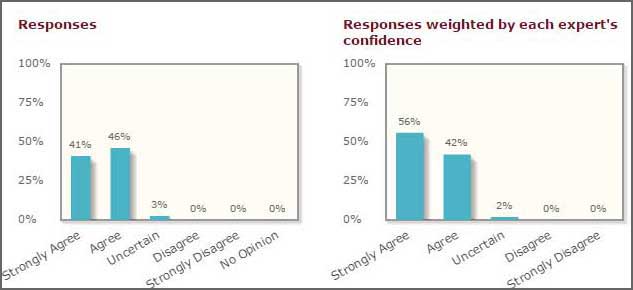

Revenue Neutral Carbon Tax Would Be Great

Source: IGM Economic Experts Panel

Verdict: A tax on carbon emissions is better than an equal-sized tax on income

Percent in agreement: 97% of polled economists agree, corrected for confidence

[Read our article on why a carbon tax is pro-business and pro-innovation]

The Brookings Institute — a nonpartisan think tank — suggested a $20 tax per ton of carbon emissions, increasing by 4% per year, is a better way to collect $150 billion of tax revenue over the next decade than by simply increasing the income tax rates to raise the same $150 billion.

The question posed to the economists was not whether raising $150 billion was necessary in the first place, just rather if this carbon tax was a better way to collect $150 billion in tax revenue as opposed to raising income taxes. So for you conservative folks out there, this logic can also be applied to a tax-cutting plan— cutting income taxes to collect $300 billion less over the next decade while also adding this $150 billion carbon tax (for a net tax cut of $150 billion) would be better than simply cutting income taxes by $150 billion.

Why?

It’s estimated that one ton of carbon emissions causes about $21 of economic cost due to increased healthcare costs, decreased agricultural productivity and environmental damage. The free market cannot naturally factor these costs into the cost of energy. By taxing carbon emissions at its real cost to society, you’re decentivizing emissions just enough to lower them to the most efficient level for the US economy. And big business is in agreement– Caterpillar CEO James Owen and FedEx CEO Fred Smith both have voiced their preference for a carbon tax over a cap-and-trade plan.

By helping the free market price energy more efficiently, a carbon tax would also help ensure the next generation of energy technologies are developed in America much better than the Solyndra fiasco.

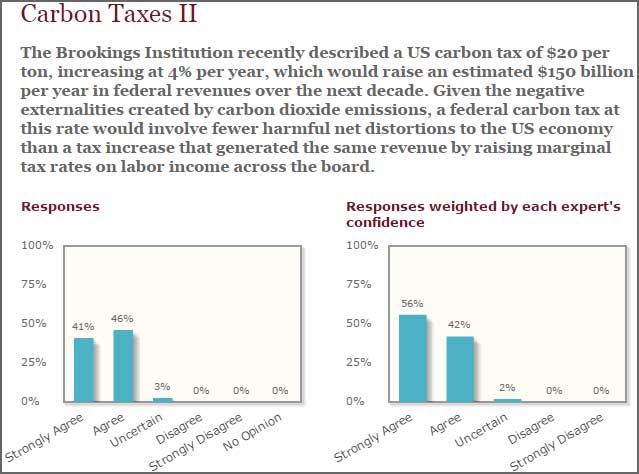

Rent Control Doesn’t Lead To Affordable Housing

Source: IGM Economic Experts Panel

Verdict: Rent control reduces the availability and quality of affordable housing

Percent in agreement: 95% of polled economists agree, corrected for confidence

Rent control is one of those issues that may sound like the “right thing to do”, but when you look at the real world effects, it’s clear they actually do a lot more harm than good for the people they’re supposed to be helping.

It’s a rather simple concept to grasp too. By restricting how much rent can be charged, builders and property managers have little incentive to build new housing units in rent-controlled areas as opposed to building somewhere else without rent controls. Therefore, there is much less supply of housing available in these rent controlled regions and buyers must compete and bid up prices on the few homes that are available. Landlords also have little incentive to maintain, repair and upgrade the current buildings they already have if they won’t get any more compensation to do so. This is why when supply is held unnaturally low, you get lower quality and higher prices. Basically, everyone loses. But low and middle-income families looking for safe and affordable places to live are hurt the most.

Here’s a great video on why rent controls not only hurt those in need most, but they also benefit people who don’t need the help in the first place:

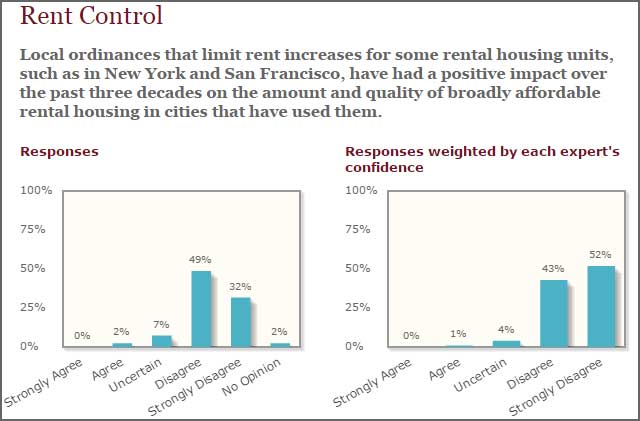

Everyone Would Benefit From More High-Skilled Immigration

Source: IGM Economic Experts Panel

Verdict: More high-skilled immigration into America would be good for the average US citizen

Percent in agreement: 95% of polled economists agree, corrected for confidence

The more educated our work force is, the more productive our businesses can be. More productivity means good and services can be provided at a lower price, which benefits the working class. [This is NOT an argument for free college, since immigration is free while education is not. Also, having the government pay for college would result in a bunch of negative consequences, which we discuss in our analysis of Bernie Sanders’ plan for free college.]

Like most economic policies, there are pluses and minuses associated with more high-skilled immigration. What matters is the net result. For instance, some highly-skilled American citizens may end up earning slightly less, since more skilled workers to choose from means lower wages. But will the benefits of lower prices and increased productivity balance out the potential negatives? Research says yes.

There’s an interesting proposal to create a market-based auction system for employers to bid on visas that might make the immigration process more efficient while limiting the potential downsides.

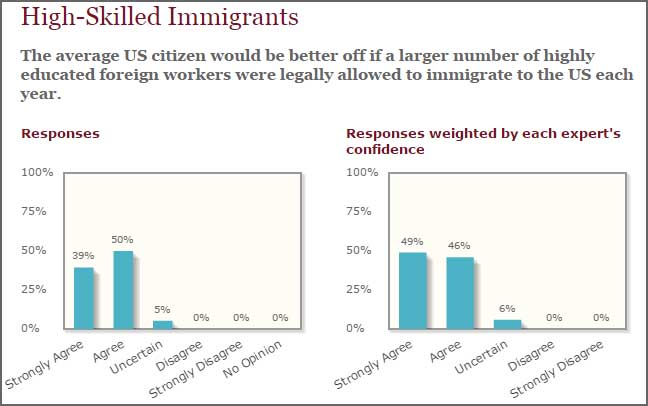

Uber Surge Pricing Is Great For Riders

Source: IGM Economic Experts Panel

Verdict: Dynamic pricing for transportation services is good for consumers

Percent in agreement: 85% of polled economists agree, corrected for confidence

About five years ago, in the pre-Uber era, my friends and I went out for a wild night of Halloween celebrations. When it was time to head home, it was pouring rain and freezing cold. Because the city only issues a fixed number of taxicab licenses, there were only a limited number of cabs available. Even on a normal, cold, rainy night, this makes for stiff competition to land a ride home since everyone needs a cab, but on particularly crowded nights like Halloween, it makes getting a taxi nearly impossible.

My friends and I ended up walking for an hour back to our apartments, wet, cold and frustrated.

Today, with Uber’s dynamic pricing, when demand for rides is high, pricing goes up. This attracts more drivers to get on the road. So when people complain a $100 Uber ride is “price gouging”, think about the alternatives– Driving drunk? Walking for an hour in the freezing cold rain? It’s not price gouging if someone would happily pay the price, and trust me– back on that cold, rainy Halloween night, we would’ve happily paid that price if we had the option.

This isn’t just anecdotal evidence– economists from this poll agree Uber’s dynamic pricing makes consumers better off overall by ensuring adequate supply of taxis. Plus this dynamic pricing allows for people to earn some extra money on the side.

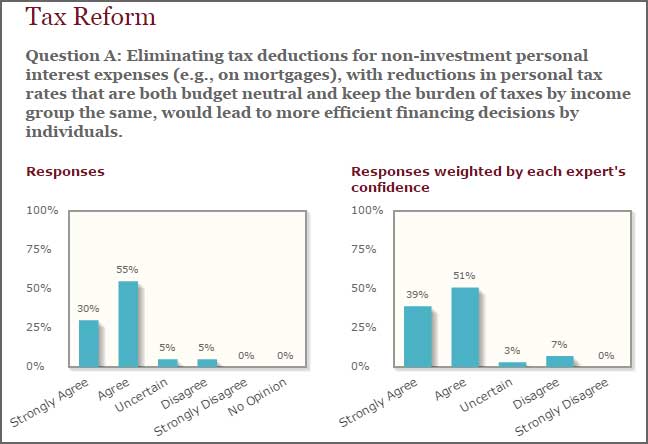

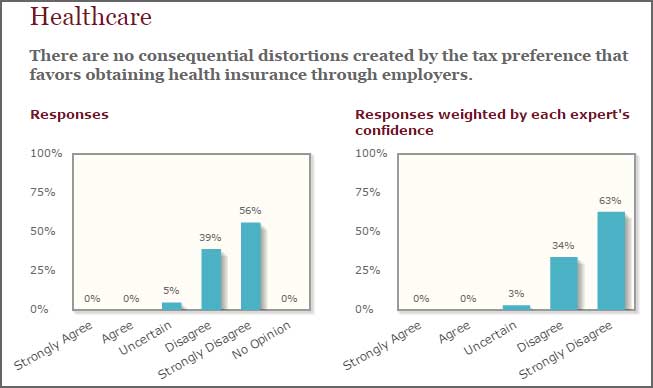

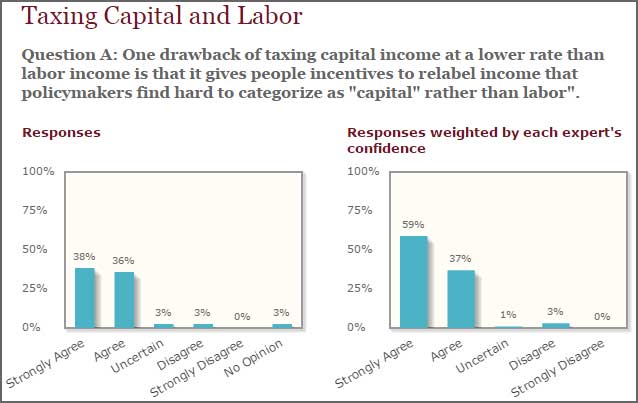

We Need To Lower Tax Rates And Eliminate Deductions

Source: IGM Economic Experts Panel

Source: IGM Economic Experts Panel

Source: IGM Economic Experts Panel

Verdict: Tax deduction for mortgage interest is bad, Tax benefits of getting health insurance through your employer is bad, Special tax rates for capital gains is bad

Percent in agreement: 90%, 97% and 96% of polled economists agree respectively, corrected for confidence.

Taxes have a dynamic effect on the overall economy. Analyzing how a tax changes people’s behavior is just as important as how much money it raises or cuts.

For example, a lot of families got into trouble during the housing crisis because they had mortgages they couldn’t afford. But that’s exactly what the tax code was providing an incentive for– the mortgage interest tax deduction encourages people to borrow as much as they can, regardless of what’s financially prudent.

Same goes for being able to buy health insurance through your employer with pre-tax dollars– it incentivizes people to purchase more coverage than they may otherwise need. It also encourages workers to stay with an employer solely to keep their health insurance when other factors indicate they should leave.

Same goes for the lower tax rate of capital gains than on income– it encourages people to work differently than they’d otherwise be best fit to. Or even worse, it encourages them to misclassify their income altogether to take advantage of a lower tax rate, which is usually an option only for wealthy individuals that can afford the legal counsel.

Not only do all these loopholes and deductions distort normal behavior, but the worst part is tax rates must be higher than they otherwise would be in order to compensate for these loopholes so our government can collect the money it needs to operate. Get rid of these tax loopholes and we can lower the tax rates, which would benefit lower and middle class families.

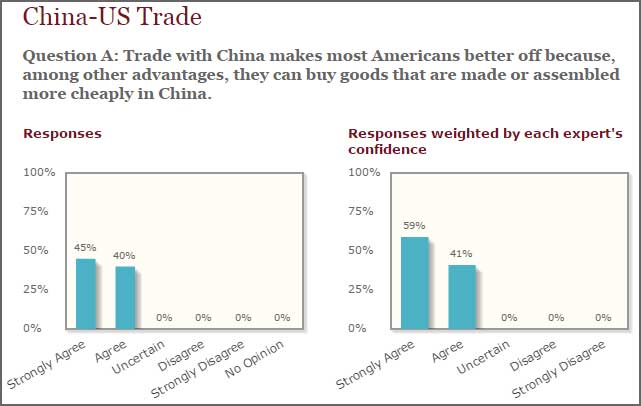

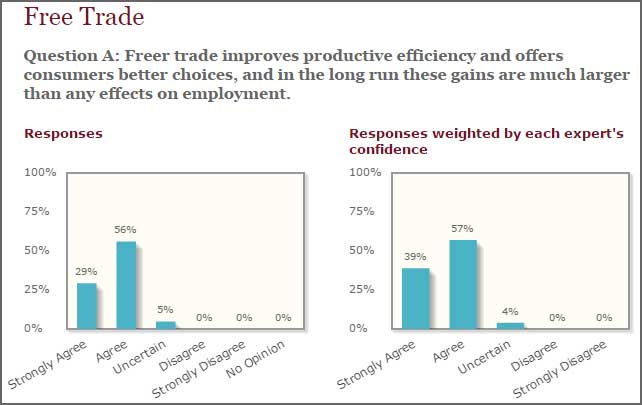

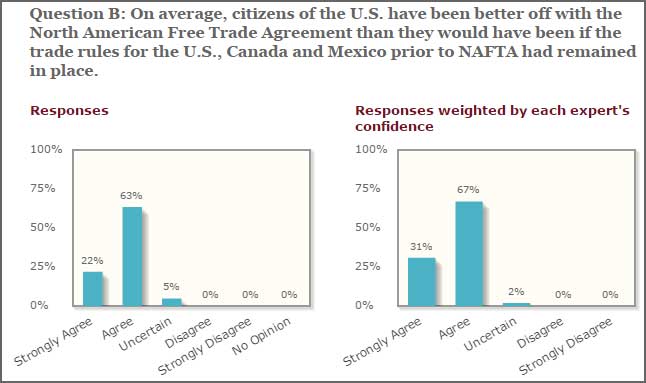

All US Citizens Are Better Off Due To Free Trade

Source: IGM Economic Experts Panel

Source: IGM Economic Experts Panel

Source: IGM Economic Experts Panel

Verdict: US trade with China makes some Americans worse off but most Americans better off, The benefits of free trade far outweigh any negative impacts of job loss, US citizens are better off from NAFTA than otherwise would’ve been if the prior trade rules remained in place

Percent in agreement: 96%, 96%, 98% of polled economists agree, respectively, corrected for confidence

Trade is a complex topic. Like most issues discussed here, there are benefits and there are drawbacks. What matters most is getting a complete picture and determining if there is a net benefit. People are typically against free trade because of the perceived job loss, but that’s an incomplete picture of how complex international trade works. Free trade may not even be the biggest threat to job loss anyway.

Over 96% of economists in the IGM Expert Panel agree that the benefits of trade far outweigh the drawbacks. A few of the economists in the panel did note that because the net positives of free trade are so beneficial for the economy, we can easily afford retraining programs and other forms of assistance while still coming out on top.

What does this all mean?

Republicans– there’s no need to be scared of a carbon tax or immigration. The fact is these policies can be very pro-business and pro-market if designed correctly. More importantly, don’t let your liberal counterparts monopolize the concept of helping those in need, because a lot of policies you hold dear would actually help lower and middle-income Americans more than policies advocated by liberals.

Democrats– if you’ve ever gotten upset with a climate-change denier because they completely disregarded what the experts overwhelmingly agree on, then by that same logic you should probably rethink ideas such as rent control, raising tax rates and arguing against free trade. Regarding NAFTA and free-trade, Bernie Sanders is a vocal opponent of NAFTA because he believes it’s bad for the country, but nearly all experts oppose his views.

Sometimes there is a right and a wrong answer. Hopefully we can start to listen to the experts when they overwhelmingly agree on economic issues. Only then will we be back on a path towards prosperity.